The E&P sector faces a steeply rising risk curve due to a combination of increasingly complex field development projects, rising country risks, highly volatile commodity prices and unstable credit markets. Crispian McCredie and Ruud Weijermars, Alboran Energy Strategy Consultants, argue that sustainable profits are generated by those companies with the most rigorous risk management framework. (more…)

Alboran Energy Strategy Consultants

-

Risk Management for Sustainable Profits

-

The Race to embrace Technological Change

Can the oil companies of the future maintain their operational integrity and meet global energy demand whilst satisfying shareholder expectations? Ruud Weijermars and Crispian McCredie, Alboran Energy Strategy Consultants, assess the outlook. (more…)

-

Bulls and Bears in Energy Trading

Expensive energy imports are a burden on any economy at a time of budgetary deficit. Crispian McCredie and Ruud Weijermars*, Alboran Energy Strategy Consultants, see a trend emerging where energy traders succeed in securing cheaper supply side contracts. (more…)

-

Leading the Energy Revolution

Europe’s exposure to expensive imports means cheap renewables will be needed to put competitive price pressure on fossil fuel suppliers. Crispian McCredie and Ruud Weijermars, Alboran Energy Strategy Consultants, highlight the hurdles for Europe in keeping its lead in the global energy transition. (more…)

-

Inflating US Shale Gas reserves

New rules have accelerated the growth of US proved gas reserves in an unprecedented way. A New York Times article prompted the US Congress to ask for a Security and Exchange Commission (SEC) investigation. Ruud Weijermars* and Crispian McCredie, Alboran Energy Strategy Consultants, outline the basis for reasonable doubts about the reliability and durability of US shale gas reserves under the new SEC rules. (more…)

-

Clockspeed Analysis & Benchmarking

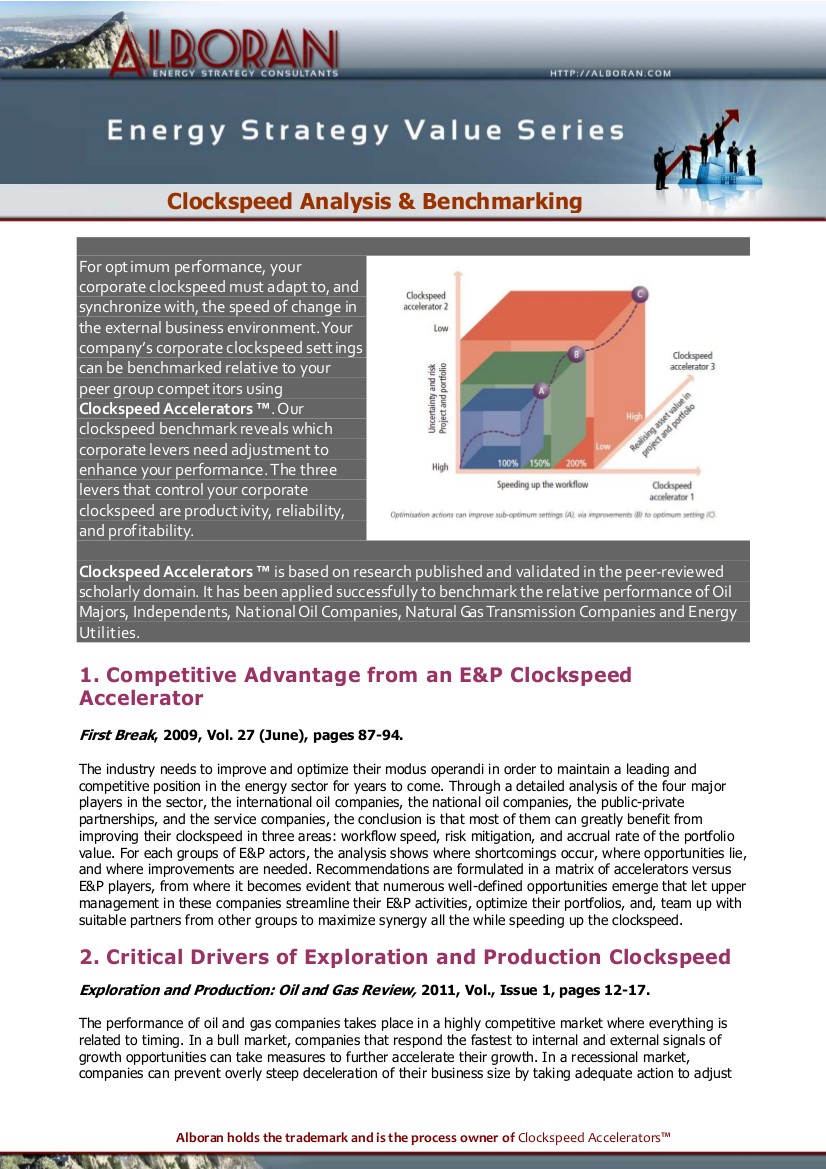

For optimum performance, your corporate clockspeed must adapt to, and synchronize with, the speed of change in the external business environment. Your company’s corporate clockspeed settings can be benchmarked relative to your peer group compet itors using Clockspeed Accelerators™. Our clockspeed benchmark reveals which corporate levers need adjustment to enhance your performance. The three levers that control your corporate clockspeed are productivity, reliability, and profitability.

Clockspeed Accelerators™ is based on research published and validated in the peer-reviewed scholarly domain. It has been applied successfully to benchmark the relative performance of Oil Majors, Independents, National Oil Companies, Natural Gas Transmission Companies and Energy Utilities.

In this issue:

- Competitive Advantage from an E&P Clockspeed Accelerator

- Critical Drivers of Exploration and Production Clockspeed

- Accelerating the three dimensions of E&P Clockspeed – A novel strategy for optimizing utility in the Oil & Gas industry

- Guidelines for Clockspeed Acceleration in the US natural gas transmission industry

-

Russian gas key to 2020 targets

With 2020 only eight years away and taking into account International Energy Agency (IEA) projections, how will Europe meet its greenhouse gas emissions targets whilst ensuring affordable energy supply? Using gas as a transition fuel means Europe must carefully weigh the risks of an increased dependency on Russia. Crispian McCredie and Ruud Weijermars, Alboran Energy Strategy Consultants, consider the dilemmas that must be solved for a new European Union energy policy. (more…)

-

The Rising Power of the Gas Traders

Securing Europe’s future gas supplies will depend increasingly on a combination of physical hubs and trading skills as gas import rise and Europe’s indigenous gas reserves dwindle. Crispian McCredie and Ruud Weijermars, ALboran Energy Consultants, explain how trading works and what action is needed to further improve liquidity in nascent pan-European gas trading system. (more…)

-

Lifting the price

The decoupling of oil and gas prices that’s occurring in the mature US markef heralds a progressive gas price decoupling from oil throughout the world. However, outside North America the world has been slow to adapt to this change. Here, Ruud Weijermars and Crispian McCredie, Alboran Energy Strategy Consultants, look at the worldwide pace of decoupling and its implications for future gas pricing. (more…)